- Anuj from OnFinance AI

- Posts

- SEBI's Latest Compliance Updates for Investment Advisers

SEBI's Latest Compliance Updates for Investment Advisers

ComplianceOS AI Newsletter | Date: October 25, 2023

We are thrilled to bring you important updates from the Securities and Exchange Board of India (SEBI) regarding significant changes in compliance requirements for Investment Advisers (IAs). At OnFinance AI, our mission is to keep you informed and equipped to navigate the evolving regulatory landscape with ease.

Our AI-powered compliance platform, ComplianceOS, has already been updated to reflect these changes, ensuring you stay ahead in compliance management.

View the demo here

Key Changes Introduced by SEBI

1. Simplified Auditor Requirements for Non-Individual IAs

Flexibility in Auditor Selection: Non-individual IAs can now obtain annual compliance certificates from any auditor for client-level segregation requirements.

Previous Requirement: Earlier, these certificates were required specifically from statutory auditors.

Timeline: Certificates must be obtained within 6 months of the financial year-end.

2. Extended Timeline for Periodic Reports

New Submission Window: IAs now have 30 days from the end of the reporting period to submit periodic reports to the IAASB.

Benefit: This extension provides greater flexibility in compliance management.

Applicability: Relevant for all half-yearly reporting requirements.

How ComplianceOS AI Helps You Adapt

Our ComplianceOS AI Agent is designed to seamlessly integrate these new requirements into your compliance processes:

Instant Updates: We've already incorporated these changes into our compliance tracking framework.

Automated Reminders: Benefit from built-in alerts for the new 30-day submission timeline.

Streamlined Documentation: Automate the generation of compliance reports and certificates.

Significant Time Savings: Reduce compliance processing time by up to 80%.

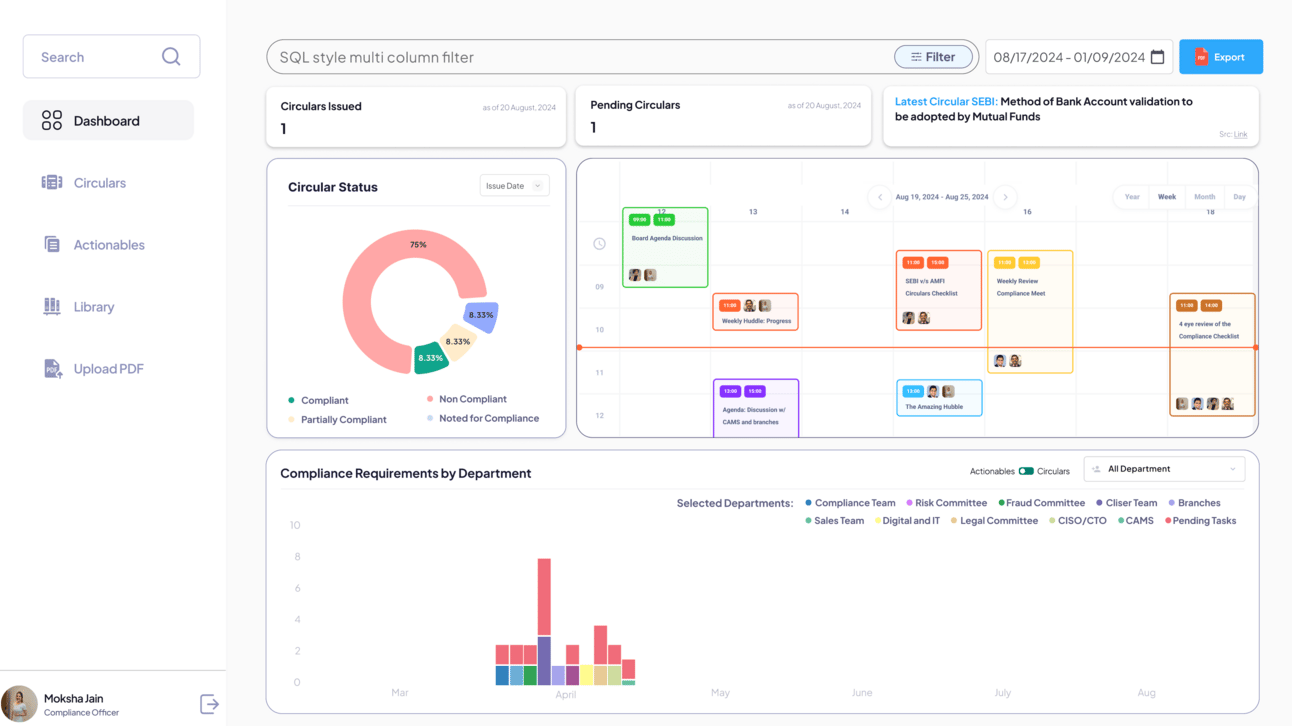

ComplianceOS AI Agent Dashboard

Impact Analysis

These regulatory changes align with SEBI's commitment to ease of doing business, potentially resulting in:

Reduced Compliance Costs: Lower expenses associated with compliance management.

Greater Operational Flexibility: More options in selecting auditors and managing timelines.

Streamlined Processes: Simplified auditor selection and reporting procedures.

Reasonable Timelines: More manageable deadlines for report submissions.

Getting Started with ComplianceOS

Your ComplianceOS dashboard has been automatically updated to reflect these changes. No additional action is required on your part to maintain compliance with the new requirements.

Not using ComplianceOS yet? Now is the perfect time to discover how our AI-powered platform can revolutionize your compliance processes.

Need Assistance?

Our team is here to support you in navigating these changes effectively. For a personalized demonstration of how ComplianceOS can further streamline your compliance efforts, please reach out to us:

Phone: +91-7233089282

Email: [email protected]

About OnFinance AI

OnFinance AI is India's premier provider of AI-powered compliance solutions for the BFSI sector. Our ComplianceOS platform helps financial institutions reduce compliance processing time by 80% while ensuring 100% regulatory adherence.

Thank you for your continued trust in OnFinance AI. We are committed to helping you achieve seamless compliance in today's dynamic regulatory environment.

Best regards,

The OnFinance AI Team