- Anuj from OnFinance AI

- Posts

- SEBI Just Dropped 2 Circulars That Will Transform Your Business

SEBI Just Dropped 2 Circulars That Will Transform Your Business

SEBI just remade the rules for FPI investments along with masterstroke to protect investor funds in the Secondary Market

We're bringing you the latest updates from SEBI's two important circulars released today, along with insights on how OnFinance AI's ComplianceOS can help streamline your compliance processes.

1. New Procedure for FPI to FDI Reclassification

SEBI has modified the procedure for reclassifying Foreign Portfolio Investment (FPI) to Foreign Direct Investment (FDI). Key changes include:

When an FPI (with its investor group) reaches 10% or more of a company's paid-up equity capital and intends to reclassify as FDI, they must follow FEMA Rules

Custodians must:

Report the intent to SEBI

Freeze purchase transactions until reclassification is complete

Process transfer requests only after RBI's prescribed reclassification reporting is complete

These provisions are effective immediately to safeguard investor interests and streamline compliance with FDI regulations

2. Trading Supported by Blocked Amount in Secondary Market

SEBI has announced significant changes to enhance investor protection in secondary market trading:

Qualified Stock Brokers (QSBs) must provide either:

Trading supported by blocked amount using UPI mechanism, or

3-in-1 Trading Account facility

Key features of 3-in-1 trading accounts:

Integration of trading, demat, and bank accounts

Automatic fund blocking for buy orders

Security blocking for sell orders

Post-market hours pay-in processing

Interest earning on available funds until pay-in

Implementation deadline: February 1, 2025

Clients retain the option to choose between existing trading methods or new facilities

How ComplianceOS AI Agent Can Help

With regulatory updates becoming increasingly frequent and complex, staying compliant can be challenging. We have got you covered!

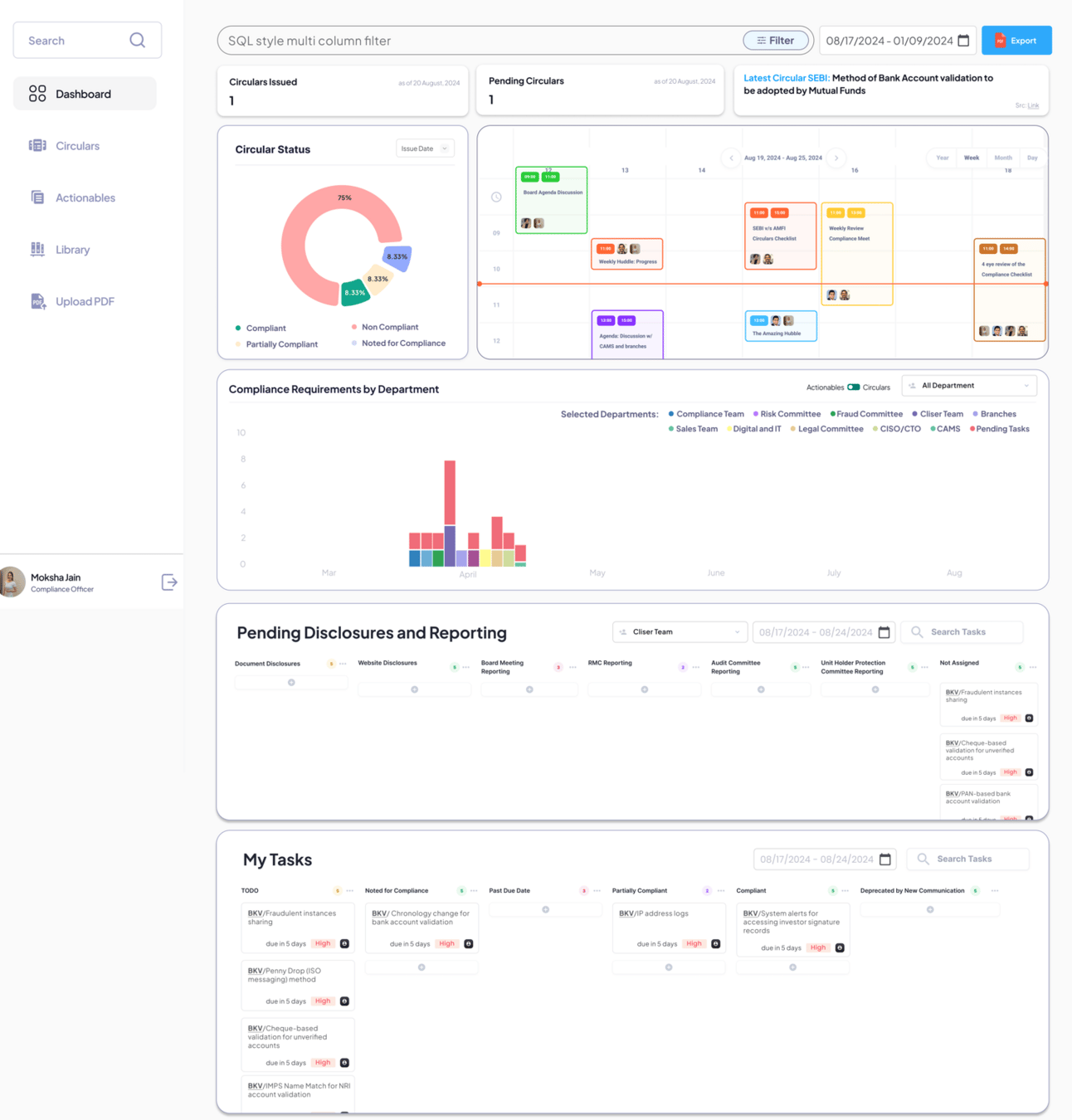

Here's how ComplianceOS transforms your compliance workflow:

Immediate Processing & Action Items

Reduces circular processing time from 60+ hours to under 10 hours per week

Generates actionable items within 5 minutes of regulatory communications

Automatically populates compliance dashboards with department-wise assignments

Automated Documentation

Creates three detailed Excel reports automatically:

Circular-Actionable Library

Circular Tracker

Regulation Library

Maintains versioned regulatory updates for easy reference

Enables natural language search across all circulars

Enhanced Efficiency

Enables one-click MIS generation

Eliminates late compliance issues

Streamlines business team processes

Provides <60 second updates between database and regulator website

Maintains comprehensive documentation trails across 20+ email chains.

Don't let regulatory compliance overwhelm your team.

With ComplianceOS, you can transform hours of manual work into minutes of automated efficiency.

Want to Learn More?

Contact us at

Email- [email protected]

Phone No.- 7233089282