- Anuj from OnFinance AI

- Posts

- SEBI's Latest Twist: 30-Day Countdown for NFO Funds—What It Means for Your Money!

SEBI's Latest Twist: 30-Day Countdown for NFO Funds—What It Means for Your Money!

SEBI has introduced several key regulations aimed at enhancing the transparency, liquidity, and overall governance of the mutual fund industry.

SEBI has issued new guidelines concerning the deployment of funds raised through New Fund Offers (NFOs) by Asset Management Companies (AMCs).

Here are the key points from the recent update:

Deployment Deadline: AMCs are now required to invest funds collected from NFOs within 30 business days from the date of allotment. If unable to meet this deadline, AMCs must provide a written explanation detailing the reasons and efforts made to deploy the funds. This documentation must then be reviewed by the Investment Committee, which can extend the deadline by an additional 30 business days if necessary.

Scheme Information Document (SID): The update includes a change in the regulatory filing process for NFOs. Specifically, AMCs must now send the initial draft of the SID exclusively to SEBI. The public will have access to the SID only five working days before the scheme is launched.

Objective of Changes: These changes aim to address issues related to delays in fund deployment observed in some NFOs, which have been attributed to factors like fund size and market volatility. By setting a firm timeline for the deployment of funds, SEBI intends to ensure that the funds are invested in accordance with the scheme’s objectives promptly.

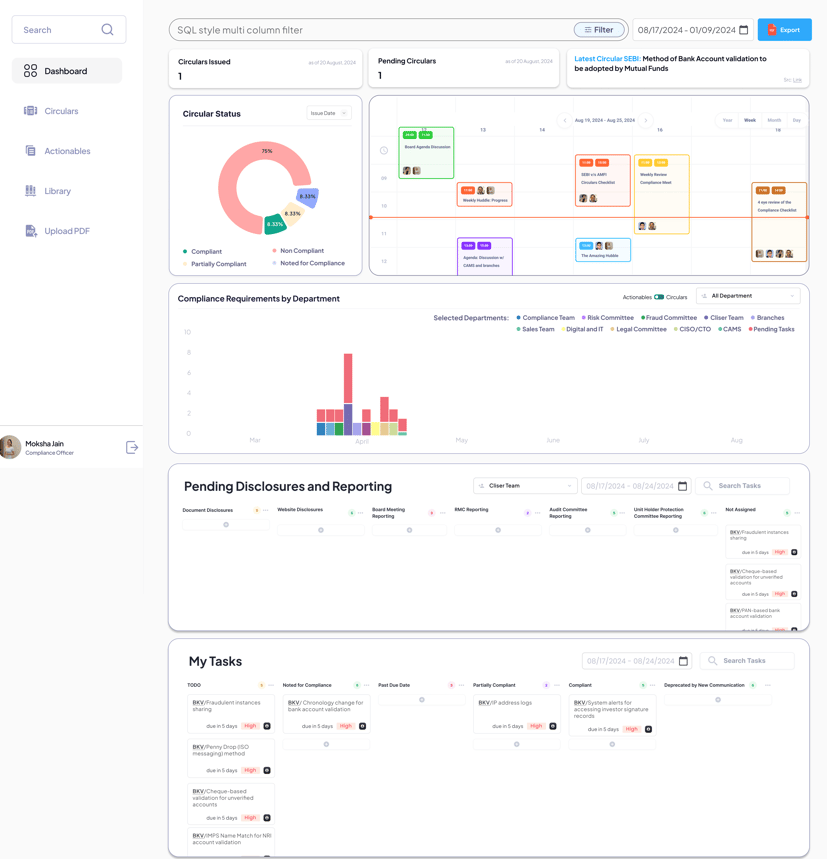

How Compliance AI Agent Can Assist:

Interpreting Regulator Communications: Quickly understands and categorizes new regulations to keep your team informed.

Department-wise Actionables Preparation: Automates the creation of actionable tasks across departments to ensure a cohesive response to regulatory changes.

Audit Preparation & Monitoring: Streamlines the preparation for audits by organizing necessary documents and evidence, reducing preparation time significantly.

One-Click MIS Generation: With just a single prompt, the tool generates Management Information System reports, facilitating swift compliance.

Implementation and Benefits:

Rapid Deployment: Can be implemented within 2 weeks, minimizing disruption.

Engineering Saved: Frees up to 2000 hours per year by automating compliance tasks.

Increased Efficiency: Reduces the time spent on compliance activities, allowing teams to focus on strategic tasks.

With the backdrop of SEBI’s regulatory overhaul, OnFinance AI's Compliance AI Agent provides mutual funds with the necessary tools to ensure compliance, enhance efficiency, and uphold transparency. This cutting-edge technology positions compliance teams to not only meet but excel in the new regulatory environment.

Contact us- [email protected] (+91)- 7233089282